Statutory & Taxation in Tally ERP 9In Tally, the features of statutory and taxation consist of configuration and functions related to statutory compliance for company. The features of statutory are related to country-specific and depend upon the country. The following features are available for statutory and taxation:

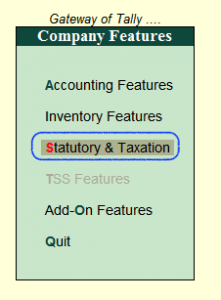

In India, Tally supports various taxations, including GST. How to enable Statutory & Taxation FeaturesIn Tally, we can use the features of Statutory and Taxation by enabling and disabling the option in the company alteration screen. We will use the following path and open the statutory and taxation: Gateway of Tally -> F11: Features -> Company Features -> Statutory Taxation

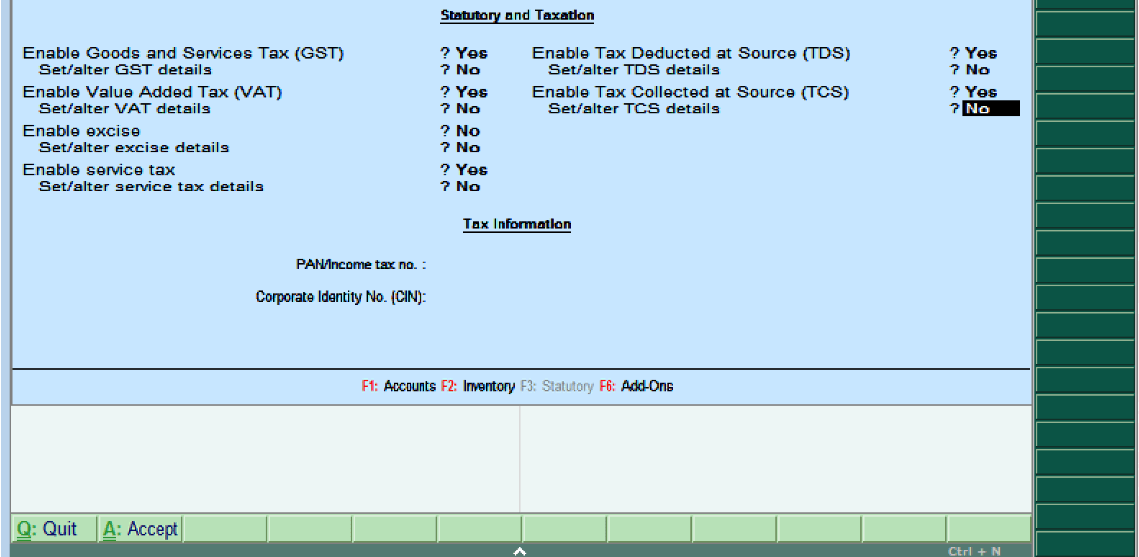

Update the following details on Company Operations Alteration Screen: Enable Goods and Services Tax (GST): If we want to use GST tax for company, enable GST option Set/alter GST details: If we want to change the GST detail, enable this option. Enable Value Added Tax (Vat): Now India is following GST tax, so disable this option as GST tax is followed by Company. Set/Alter VAT details: If we want to select No, choose this option. Enable Excise: If we want to use the Excise, enable this option Set/alter excise details: If we want to change the excise details, enable this option Enable Service Tax: If we want to use the service tax by company, enable this option Set/alter service tax details: If we want to alter the service tax details, enable this option Enable Tax deduction at source: If we want to use TDS, enable this option Set/alter TDA details Enable Tax collected at Source: If we want to use TCS, enable this option Set/alter TCS details Tax Information: Income/PAN Tax No: Update the company permanent Income tax number or account number in this field. Corporate Identify No: Update the CIN number of company in this field.

In Tally ERP 9, after updating all the required details for statutory and taxation, choose A: Accept to save the details.

|

- Class 12

- Class 11

- Class 10

- Class 9

- Class 8

- Class 7

- Class 6

- CLASS (1-5)

- other

- Calculators

- All Calculators

- Calculators List

- Algebra Calculator

- Equation Solver

- Graphing Calculator

- Elimination Calculator – Solve System of Equations with

- Derivative Calculator

- Absolute Value Equation Calculator

- Adding Fractions Calculator

- Factoring Calculator

- Fraction Calculator

- Inequality Calculator

- Mixed Number Calculator

- Percentage Calculator

- Quadratic Equation Solver

- Quadratic Formula Calculator

- Scientific Notation Calculator

- Simplify Calculator

- System of Equations Calculator

- NCERT MCQs

- Tally

- Accounting in Hindi

- Ms Office

- Maths Important Questions

- Python Tutorial

- Calculators

- Class 12

- Class 11

- Class 10

- Class 9

- Class 8

- Class 7

- Class 6

- CLASS (1-5)

- other

- Calculators

- All Calculators

- Calculators List

- Algebra Calculator

- Equation Solver

- Graphing Calculator

- Elimination Calculator – Solve System of Equations with

- Derivative Calculator

- Absolute Value Equation Calculator

- Adding Fractions Calculator

- Factoring Calculator

- Fraction Calculator

- Inequality Calculator

- Mixed Number Calculator

- Percentage Calculator

- Quadratic Equation Solver

- Quadratic Formula Calculator

- Scientific Notation Calculator

- Simplify Calculator

- System of Equations Calculator

- NCERT MCQs

- Tally

- Accounting in Hindi

- Ms Office

- Maths Important Questions

- Python Tutorial

- Calculators