Double column cash book

The double column cash book (also known as two column cash book) has two money columns on both debit and credit sides – one to record cash transactions and one to record bank transactions. In other words, we can say that if we add a bank column to both sides of a single column cash book, it would become a double column cash book. The cash column is used to record all cash transactions and works as a cash account whereas bank column is used to record all receipts and payments made by checks and works as a bank account. Both the columns are totaled and balanced like a traditional T-account at the end of an appropriate period which is usually one month.

Since a double column cash book provides cash as well as bank balance at the end of a period, some organizations prefer to maintain a double column cash book rather than maintaining two separate ledger accounts for recording cash and bank transactions.

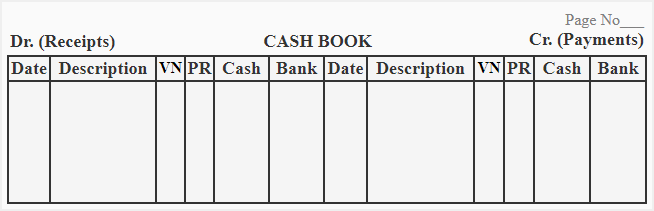

Format

The format/specimen of a double column cash book is given below:

The above format of double column cash book has six columns on both debit and credit sides. The purpose of cash and bank columns has been explained at the start of this article and the purpose of date, description, voucher number (VN) and posting reference (PR) columns has been explained in single column cash book article.

Important points to remember while making entries in a double column cash book

Recording cash transactions:

- All cash receipts are recorded in cash column on the debit side and all cash payments are recorded in cash column on credit side of the double column cash book.

- If cash is received from a debtor or customer and is deposited into the bank account on the same date, the entry will be made in the bank column on the debit side, not in the cash column.

Recording bank transactions:

- When a check is received and the same is deposited into the bank account on the same date, the amount of the check is entered in the bank column on the debit side.

- When a check is received and the same is not deposited into the bank on the same date, the amount of the check is entered in the cash column, not in the bank column.

- When a check received from a receivable on a date subsequent to its receipt is deposited into the bank account, the entry is made in the bank column on the debit side and in the cash column on credit side. It is called a contra entry.

- When a check is issued, the amount of the check is entered in the bank column on the credit side.

Recording contra entries:

The “contra” is a Latin word which means against or opposite. The contra entry is an entry which involves a cash account and a bank account and which is recorded on both debit and credit sides of the double column cash book at the same time. This entry is not posted to any ledger account because both debit and credit aspects of transaction are handled within the cash book and the double entry work is completed. In posting reference column, the letter “C” is written to denote that the entry is a contra entry and will not be posted to any ledger account. A contra entry is made in the following circumstances:

(1). When cash is deposited into the bank account:

The entry for depositing cash into the bank account is:

Bank [Dr]

Cash [Cr]

The deposited amount is written in the bank column on debit side and cash column on credit side.

(2). When cash is withdrawn from bank account for business use:

The entry for withdrawal of cash from bank account for business purpose is:

Cash [Dr]

Bank [Cr]

The withdrawn amount is written in the cash column on debit side and bank column on credit side.

Important: The contra entry is made only when the cash is withdrawn for business use. If cash is withdrawn for personal use, it will be recorded only in the bank column on credit side of the cash book.

(3). When a check received from a receivable or customer on a date subsequent to its receipt is deposited into the bank account:

When a check is received and is not deposited into the bank account on the same date, it is recorded in the cash book just like a normal cash receipt. On a subsequent date, when the check is deposited into the bank account, the following entry is made:

Bank [Dr]

Cash [Cr]

The amount of the check is recorded in the bank column on debit side and cash column on credit side.

Balancing and posting a double column cash book

Both cash column and bank column of double column cash book are totaled and balanced at the end of an appropriate period. The process of balancing and posting a cash book has been explained in detail in single column cash book article. The same process is also applicable to a double column cash book.

The following example summarizes the whole explanation given above.

Example

The Edward Company uses a double column cash book to record its cash and bank related transactions. It engaged in the following transactions during the month of March 2018:

- March 01: Cash balance $1,450 (Dr.), bank balance $1,500 (Dr.).

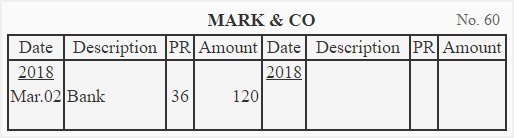

- March 02: Paid Mark & Co. by check $120.

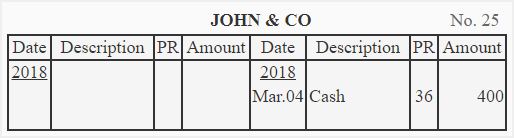

- March 04: Received from John & Co. a check amounting to $400.

- March 05: Deposited into bank the check received from John & Co. on March 04.

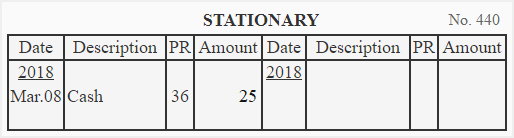

- March 08: Purchased stationary for cash, $25.

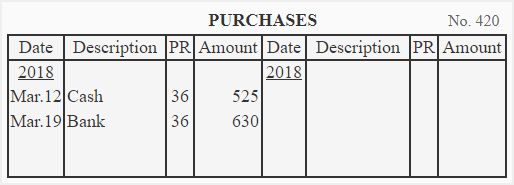

- March 12: Purchased merchandise for cash, $525.

- March 13: Sold merchandise for cash, $1,800.

- March 15: Cash deposited into bank, $850.

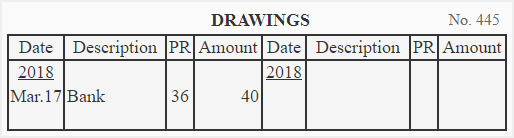

- March 17: Withdrew from bank for personal expenses, $40.

- March 19: Issued a check for merchandise purchased, $630.

- March 20: Drew from bank for office use, $150.

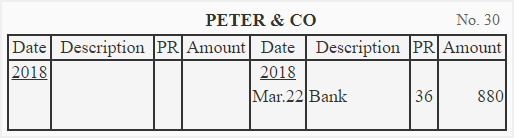

- March 22: Received a check from Peter & Co. and deposited the same into bank immediately, $880.

- March 25: Paid a check to Daniel Inc. for $270.

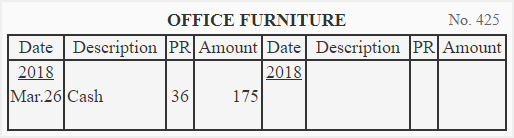

- March 26: Bought furniture for cash for office use, $175.

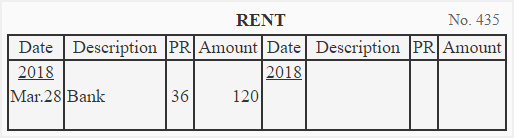

- March 28: Paid office rent by check, $120.

- March 29: Cash sales, $650.

- March 30: Withdrew from bank for office use, $145.

- March 31: Paid salary to employees by check, $300.

Required: Record the above transactions in a double column cash book and post entries therefrom into relevant ledger accounts.

Solution

Cash book:

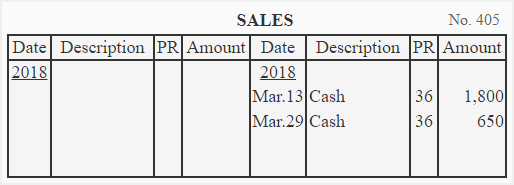

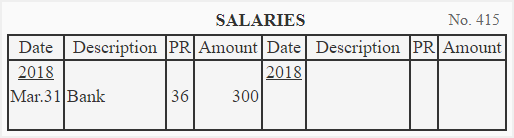

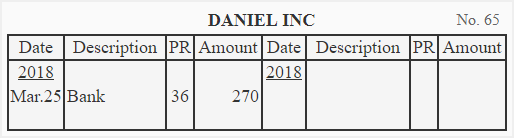

General ledger:

Accounts receivable subsidiary ledger:

Accounts payable subsidiary ledger: